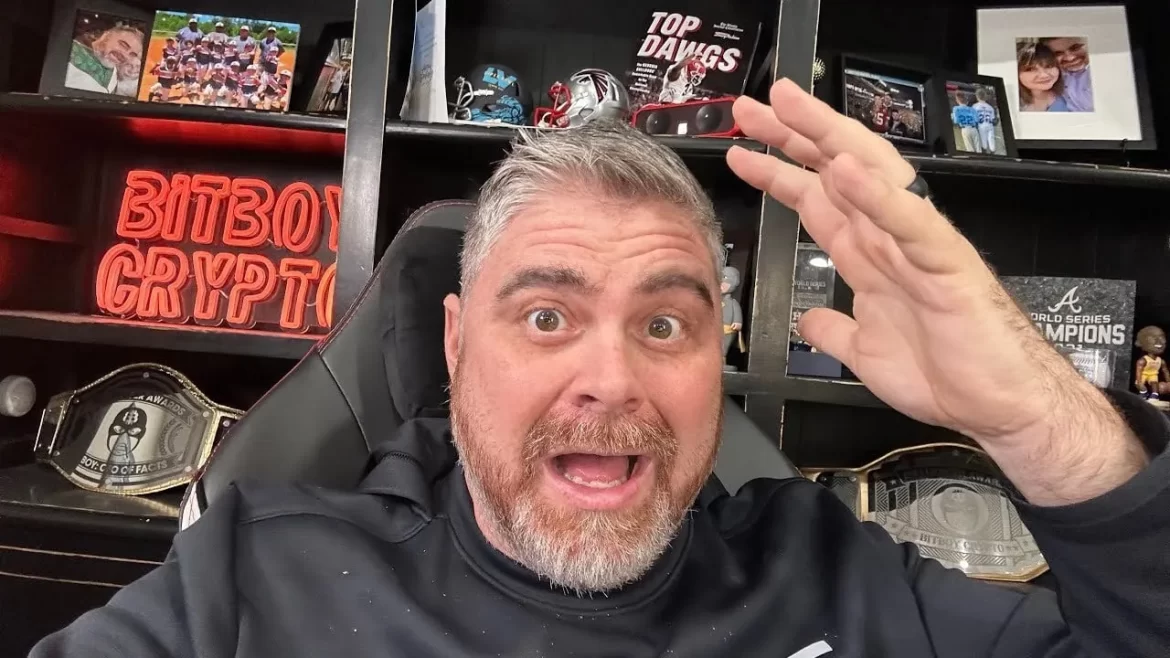

YouTube influencer Ben “BitBoy” Armstrong and Miami Heat basketball star Jimmy Butler have agreed to pay $340,000 in monetary relief to settle claims that they promoted the sale of unregistered securities offered through Binance, according to The Moskowitz Law Firm.

The class-action lawsuit brought last March alleges that Armstrong and Butler helped the crypto exchange engage in the sale of unregistered securities, which include Binance’s BNB token and BUSD, a Binance-branded stablecoin once issued through the firm Paxos Trust.

Armstrong and Butler are among several defendants in the class-action lawsuit led by The Moskowitz Law Firm and Boies Schiller Flexner, including Binance’s founder and former CEO Changpeng Zhao, along with Binance.US, which operates under BAM Trading Services.

In a court filing shared with Decrypt, Butler “adamantly denies all wrongdoing whatsoever,” stating he would “be absolved of all liability if this matter were litigated to a conclusion.”

Armstrong, meanwhile, stated that he “believes he possesses valid defenses” to plaintiffs’ claims that he engaged in the promotion of unregistered securities.

The pair nonetheless chose to settle over continued litigation. Under their respective agreements, Butler agreed to pay $300,000, while Armstrong agreed to pay $40,000 in monetary relief.

Armstrong’s payment represents “the total sum paid to [the] defendant by any and all sources,” the court document states, adding Armstrong will submit a statement that he “had no personal knowledge that any of the Binance offerings were the sale of an unregistered security.”

The Moskowitz Law Firm’s Managing Partner Adam Moskowitz has a history with Armstrong. After Armstrong was named in a class action lawsuit against celebrity promoters of FTX, Moskowitz contacted the FBI, saying Armstrong had sent him threatening messages.

The settlement agreements were the product of leverage, Moskowitz told Decrypt. Based on a recent court ruling from U.S. District Judge Federico Moreno, Moskowitz wrote promoters can be held liable for statements made broadly on the internet instead of those targeted solely at specific investors.

“One of the main questions pending in most of these crypto cases is whether plaintiffs just state a cause of action under the securities laws,” he wrote of class-action lawsuits, adding Moreno’s decision found that promotion along with a “financial incentive” was enough to bring a case.

The concept emerged in the class-action lawsuit against basketball legend Shaquille O’Neal over his Solana-based NFT project Astrals. Partially grantingO’Neal’s motion to dismiss last week, Moreno still found “personalized” or “individualized” communications weren’t necessary for O’Neal to be considered a “seller” of Astrals’ NFTs or governance token.

- Fed Chair Powell Told House Democrats U.S. Needs Stablecoin Bill

- House Dems Warn of Corruption in Trump’s Crypto Business Moves

- Following Fidelity’s Lead, Grayscale Looks to Add Staking For its Proposed Ethereum ETF

- South Dakota Seeks to Establish Bitcoin Reserve as More States Join the Trend

- Feds Are Investigating Jack Dorsey’s Block Over it’s Bitcoin Business

- Arizona Lawmakers Advance Bill to Shield Cryptocurrency From Property Taxes