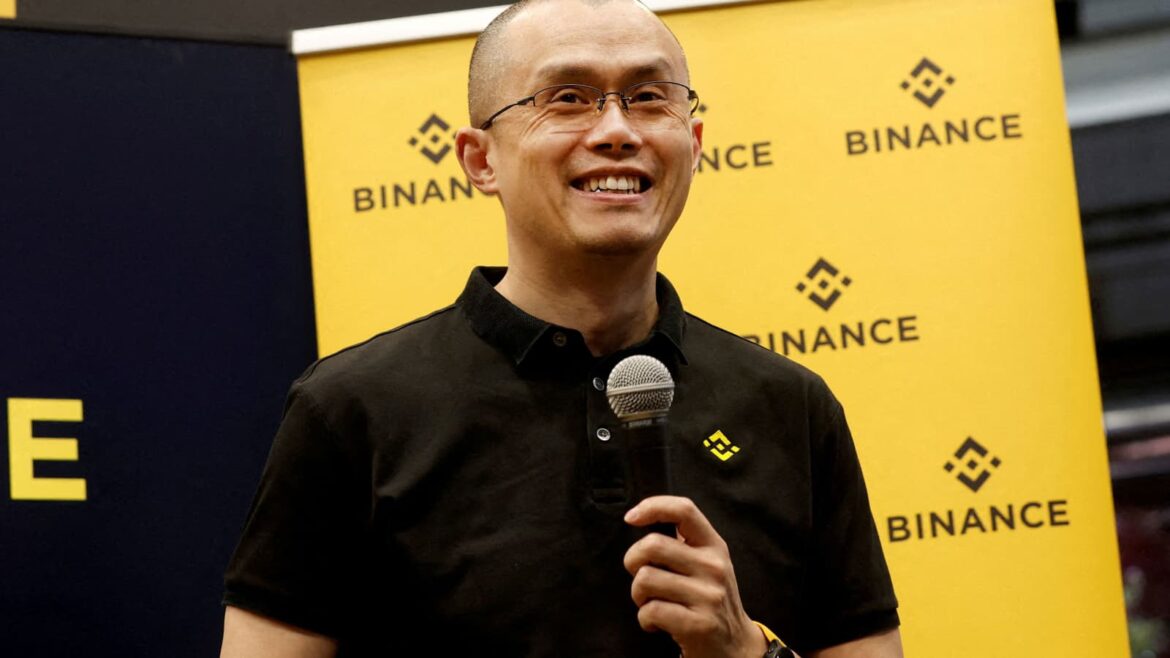

Binance founder and former CEO Changpeng “CZ” Zhao is set to be released from Long Beach Residential Reentry Management (RRM) on September 29, as confirmed by the US Federal Bureau of Prisons (BOP). CZ began serving his four-month sentence in the Federal Correctional Institution Lompoc, a low-security prison in California, following a conviction in April 2024.

His sentence, tied to a US Department of Justice (DOJ) investigation, centered on allegations that Binance failed to implement effective anti-money laundering (AML) measures, which allowed for misuse of the platform by cyber criminals and other illicit actors. CZ paid a $50 million fineand stepped down as Binance’s CEO to settle the multi-year probe, which also included a $4.3 billion fine against the exchange itself.

Although Zhao’s legal issues garnered media attention last year, his impending release is reviving discussions on social media sites like Twitter. Crypto fans and investors are making predictions about the possible market moves of tokens associated with Binance and CZ as the day draws near.

The upcoming release of Binance founder CZ has fueled excitement in the crypto community, with Binance Chain tokens like BNB, CAKE, XVS, and FTM under close watch. Investors anticipate potential price surges as CZ’s return could boost confidence in these tokens, which are key to the Binance ecosystem. His leadership remains influential, making these assets a focal point for traders ahead of his release.

While Binance has faced regulatory challenges, the community’s focus on these tokens indicates optimism that CZ’s release could have positive ripple effects on Binance-associated assets.

- US Government Shutdown Leads to Halt of SEC Approvals for Crypto ETFs

- Trump’s Sovereign Wealth Fund Move Sparks Curiosity Over Potential US Bitcoin Acquisitions

- Senate Banking Committee Faces Pressure on Stablecoin Rewards From Banking Sector

- Trump Picks Crypto Advocate Paul Atkins For SEC Chair

- New Bill Proposes Blockchain For Fair Elections in New York

- Solana Labs, Jito Labs Hit with RICO Charges in Amended Pump Fun Fraud Lawsuit